Table of Contents

Download Or View BIN Details

The Book Identification Number (BIN) quoting has named mandatory for government deductors. And also those who are detailing TDS without payment through bank challans. The BIN is a unique verification key. It disperses by the Assessing Officer (AO) to the relating DDO ought to be accurately filled in the TDS/TCS statement, according to information accessible in the BIN view. Today we are covering a part of the significant role of BIN.

View/Download Book Identification Number (BIN) Details

- To Download Book Identification Number (BIN) Details Click on the accompanying Link :-https://onlineservices.tin.nsdl.com/TIN/JSP/etbaf/ViewBIN.js.

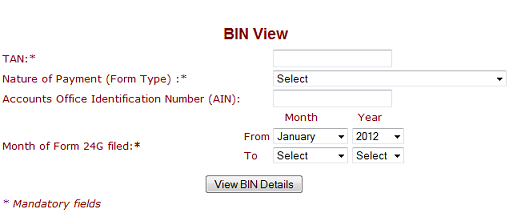

- Enter the Following details in the field provided on the above link.

NOTE:

- To view BIN details, give TAN, Nature of Payment, Form 24G month/year run.

- Moreover, to view BIN details of specific A.O., provide the AIN with A.O. despite the above mandatory information.

- Book Iditenfication Number cities in the Transfer voucher details. It generates while setting up the quarterly TDS/TCS statements.

- The period chose ought to be inside 15 months.

- For Form 24G filed for F.Y. 2010-11 onwards, the BIN view is accessible.

- If BIN details for referenced AIN and period are not available, please contact your particular Pay and Accounts Office (PAO). Or, District Treasury Office (DTO) to whom the TDS/TCS has reported.

- BIN comprises of the accompanying:

- Receipt Number: Seven digits unique number generated for each Form. I.e., 24G statement effectively-acknowledged at the TIN focal system.

- DDO Serial Number: Five digits unique number also developed for each DDO record. It includes valid TAN in the Form 24G statement effectively-acknowledged at the TIN focal system.

- Date: It will be the last date of the month and year for which TDS/TCS has been reported in Form 24G.

Some significant focuses in regards to Book Identification Number:

To view/download BIN details, select the period for which Form 24G statements have filed. But, to view/download BIN for explicit TAN, notice the TAN of DDO and period (Month and Year) for which Form 24G statements have filed.

Moreover, Receptacle will generate for those DDO records for which valid TAN have provided.

But, the client will have the option to demand BIN (view/download) most extreme for 12 months.

Verification of the measure of tax dispatched to the Government is discretionary. So about confirm the extent of tax delivered, the A.O. needs to choose the checkbox and give the estimate of tax. On the off chance, the details match with the sum present at the TIN focal system. Or else it will show ‘Confound in Amount.’ Any small business needs to streamline their accounting, make sure to know-how!

- The carat (^) isolated text file will be downloadable.

- Furthermore, The downloaded files will compact, and the secret word remains ensured.

- Concentrate Zip file containing BIN details in text form by utilizing WinZip rendition 9.0 or more, WinRAR variant 3.90 or more, and 7-Zip adaptation 4.65 or more.

- But, the Password for separating the substance of the BIN file will be seven digits AIN.

- The file will contain a DDO record with valid TAN alongside relating BIN.

- Moreover, In the event of an enormous number of records, files will be part of many files.

BIN GENERATION

To begin with, Given the details presented by the DDOs, the separate DTO/PAO will file Form No.24G (which is a monthly e-TDS return).

Moreover, On the effective filing of Form No.24G, a unique Book Identification Number will display on the Tax Information Network (NSDL). But, only after the individual Principal Accounts Officer files monthly statements with Form 24G. Moreover, It must quote in quarterly returns. The client may contact the individual Assessing Officer and gather the essential BIN details.

Outcomes of Not Quoting BIN

Receptacle details and the measure of TDS reported in the quarterly TDS statement filed by the DDO. Yet, it will remain applicable for cross-checking, along with the details recorded in the Form No.24G filed by the PAO for verification purposes; moreover, If there should arise an occurrence of any inaccurate information reported by the DDOs in the TDS statement. Thus, endeavored verification will bring about befuddle. The reason being, the credit to the particular deductee won’t be accessible in the Form 26AS relating to the deductee. Henceforth, the BIN by the separate PAO ought to be reported. Alongside the relating sum in the TDS statement filed by the DDOs.